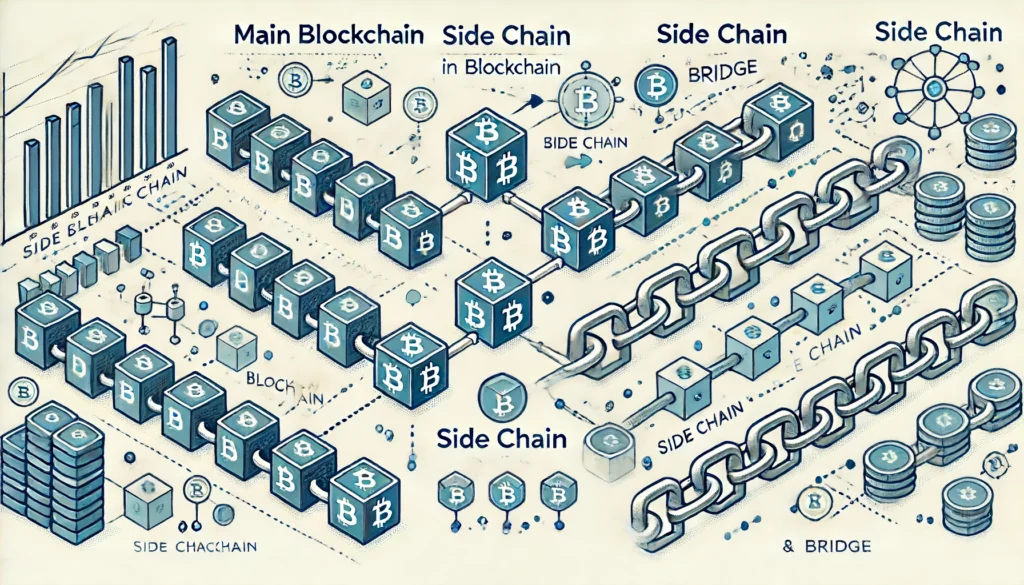

As we move down through the Layer-2 solutions of our blockchain architecture, we get a glimpse of the programmed mechanisms that further increase scalability and efficiency. We’ve explored the basic idea of mechanisms, state channels, payment channels, and hash locking. Next on the menu are side channels and bridges, two of the most vital building blocks. These mechanisms form an essential part of the interconnection of blockchain networks. Thus, this critical interoperability, advanced by bridges, powers up the functionalities of the blockchain ecosystem

SIDE CHAINS

Side channels run off the main blockchain, which is a way of allowing many parties to make numerous transactions without having to transmit every individual transaction onto the main chain immediately. Only the final state or a summary of all the interactions is on-chain, making the process less cumbersome and, therefore, enhancing network efficiency.

DIFFERENCE BETWEEN SIDE CHAINS AND STATE CHANNELS

While state channels and side channels, in general, reduce the chain congestion by allowing off-chain execution of transactions, there is a difference between the two:

- State Channels: Parties to state channels are mostly for off-chain state transitions, which first open between parties by creating a multi-signature transaction on the main chain, then transact off-chain, and at the last stage, broadcast the final state back onto the blockchain. These are also widely known as off-chain channels.

- Side Channels: More generally, they involve functionalities other than state transitions only; they are actually complex computations and interactions among a multiplicity of parties or systems.

ANALOGY FOR SIDE CHAINS

Consider for a moment that you have a favourite coffee shop in your favourite part of town, but every time you get there, it is just filled with people, and you find yourself stuck in long queues just for the possibility of getting a sip of your much-needed, essential morning brew. This favourite coffee shop is similar to the Ethereum mainnet, where everybody wants to get their transactions done like everybody wants a coffee.

Now, let’s introduce the concept of sidechains. Picture sidechains as extra coffee shops that spring up in the neighbourhood. These sidechains have their own baristas and their own environments, but they are all linked or owned by the main coffee shop in the neighbourhood, with easy access from the inside.

HERE’S HOW IT WORKS :

1. The Main Coffee Shop (Ethereum Mainnet):

- That is where the vast majority of transactions take place—much like your favourite bustling coffee shop.

- But just because it’s popular, it’s easily crowded, resulting in long waits (high gas fees) and full spaces (network congestion).

2. The Side Coffee Shops (Sidechains):

- These are the supplementary coffee shops created by the main shop to ease the load.

- As each side coffee shop has its own baristas and sitting areas, side chains also have their own validators and sets of mechanisms for transaction processing, which, to a limited extent, could even have different consensus mechanisms.

- Since they’re not as popular as the main coffee shop, they’ll be less crowded, and you can get your coffee faster and at a lower cost, but their quality or service may or may not be better than at the main shop.

3. Connecting the Coffee Shops (Interoperability):

- Let’s say that these coffee shops are all linked by bridges.

- You can go back and forth between the main coffee shop and the side coffee shops for fast service if the main shop is overloaded.

- To put it in the terms of blockchain, bridges facilitate the free flow of assets and data between the Ethereum mainnet and the sidechains.

4. Scalability and Flexibility:

- Such side coffee shops will not only reduce the congestion in the main shop but will also provide more avenues for people to get their coffee.

- People who prefer a more intimate setting will always go there, and others will always stick to the main shop because of their familiarity.

- In the same manner, side chains will provide scalability by offloading transactions from the main net and at the same time provide flexibility in governance and the consensus mechanisms.

That’s it; sidechains are basically another way of providing a more agile environment for transaction processing and, at the same time, reducing some of the pressures from the Ethereum mainnet.

BLOCKCHAIN BRIDGES

Interoperability across dissimilar blockchain networks is at the heart of blockchain bridges. They make it possible for digital assets and data to be moved from one blockchain to another for the overall increase in utility and value of blockchain networks through interoperability.

A blockchain bridge is a piece of technology that provides an interface that enables either access or connection of two or more blockchain networks to interact with each other. In short, blockchain bridges are vital for:

- Interoperability: Making it easy to interact across the different blockchain platforms, bettering the user experience, and facilitating more complex and integrated decentralized applications.

- Asset Transfer: Allowing tokens and assets to move between blockchains, thus broadening their usability and liquidity.

- Network Efficiency: Spreading workloads and resources across chains for better overall network performance.

Interoperability in blockchains refers to the capability of different blockchain systems to be able to communicate and interchange data or assets seamlessly.

TYPES OF BRIDGES IN BLOCKCHAIN

1. Two-Way Pegs:

Assets can be locked on one blockchain, and an equal value can be minted onto another. Such a mechanism will ensure that locked assets on the original blockchain cannot be double-spent. The equivalent amount can now be used on the other blockchain.

2. Wrapped Tokens:

For example, tokens on one chain that are based on assets on another, like Wrapped Bitcoin (WBTC), represent Bitcoin on Ethereum. Just like the original assets, these tokens are created with a similar amount of the asset value on the source chain; they are natively from the target chain.

3. Cross-Chain Communication Protocols:

Allow the blockchains to share information and states that ensure synchronized operation of networks. For example, the IBC (Inter-Blockchain Communication) protocol makes communication among various blockchains possible and is used by the Cosmos network.

ANALOGY FOR BRIDGES

There are two islands, Island A and Island B. Both have their own separate coins—Island A coins on the Island A ledger and Island B coins on the Island B ledger. The residents use these coins for transactions within their own islands.

So, now, consider yourself as a tourist who wants to visit both islands and buy items using the Island A coins on Island B and vice versa. Only you will have a problem: the currency of each Island is not natively compatible with the other.

HERE’S HOW IT WORKS

1. Locking Assets on Island A:

- To use your Island A coins on Island B, your first order of business would be to lock your assets in a safe vault or secure deposit box on Island A so that everything is taken care of and secure during your travel.

2. Crossing the Bridge:

- Crossing the bridge and taking a boat to go to Island B means the assets are being transferred between different blockchain networks.

3. Unlocking and Conversion on Island B:

- When arriving at Island B, the first thing to do is unlock the assets again and convert them into Island B’s native currency, the Island B coin.

- In this process, smart contracts mint the equivalent amount of Island B coins to the amount of locked assets on Island A so that your assets are compatible with the currency used on Island B, allowing you to purchase and transact within the community.

4. Two-Way Transfer:

- Similarly, if you want to use Island B coins on Island A, you would follow a similar process in reverse, locking your assets on Island B, crossing the bridge back to Island A, and converting your assets into Island A coins.

IN THIS ANALOGY

- Island A represents one blockchain network (e.g., the Polygon network).

- Island B represents another blockchain network (e.g., the Ethereum mainnet).

- The Island A coins and Island B coins represent the native tokens or cryptocurrencies used within each blockchain ecosystem.

- The bridge represents the mechanism or protocol that facilitates the transfer of assets between different blockchain networks, ensuring interoperability and compatibility.

CONCLUSION

Thus, side channels and bridges are considered to be emerging fast as the enabling technologies for most current challenges in blockchain scalability and interoperability. These technologies enhance the efficiency of individual blockchain and give a unified and connected blockchain ecosystem. It is getting to know those technologies more and more, exploring their development, and determining how important they will be in the future of decentralized systems.